Ravi didn’t know it, but he, like millions of Americans, was trapped in a “ghost network.” As some of those people have discovered, the providers listed in an insurer’s network have either retired or died. Many other providers have stopped accepting insurance — often because the companies made it excessively difficult for them to do so. Some just aren’t taking new patients. Insurers are often slow to remove them from directories, if they do so at all. It adds up to a bait and switch by insurance companies that leads customers to believe there are more options for care than actually exist.

Ambetter’s parent company, Centene, has been accused numerous times of presiding over ghost networks. One of the 25 largest corporations in America, Centene brings in more revenue than Disney, FedEx or PepsiCo, but it is less known because its hundreds of subsidiaries use different names. In addition to insuring the largest number of marketplace customers, it’s the biggest player in Medicaid managed care and a giant in Medicare Advantage, insurance for seniors that’s offered by private companies instead of the federal government.

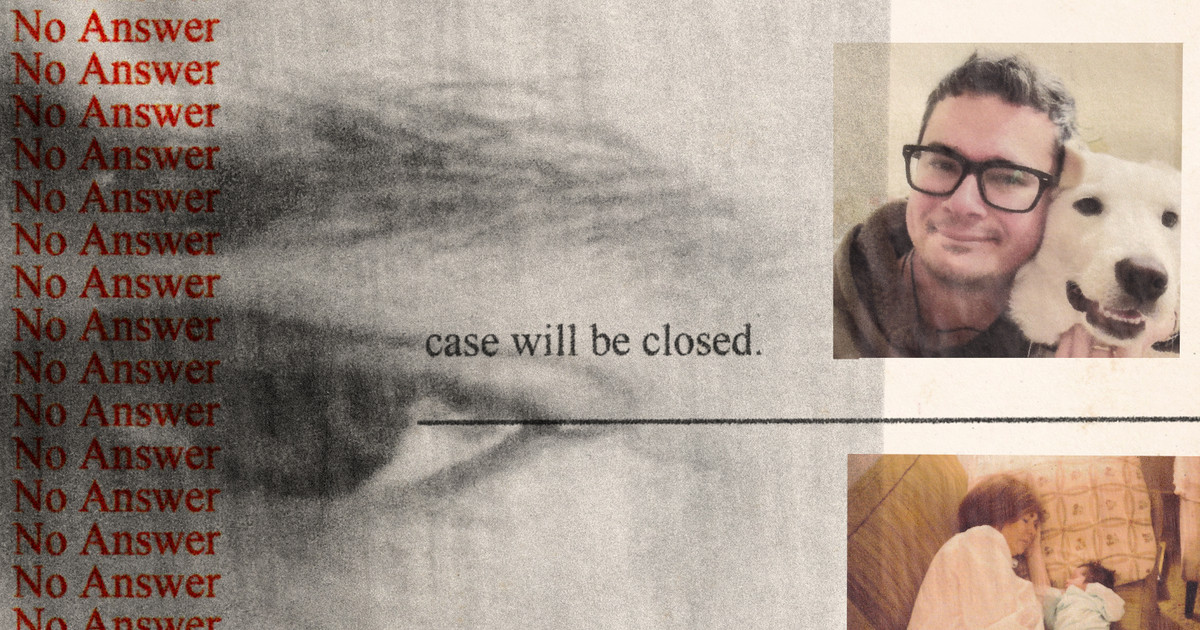

ProPublica reached out to Centene and the subsidiary that oversaw Ravi’s plan more than two dozen times and sent them both a detailed list of questions. None of their media representatives responded.

Imagine you have to choose a health insurance company to be insured with like you choose a credit card (Visa, Mastercard, etc). Many doctors (shops) only accept certain insurance providers (cards) due to fees and other regulations.

The problem described in this article is when your insurance lists doctors that you can go to that will accept your insurance, but most of them have gone out of business or actually don’t accept your particular insurance anymore.