- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

I know this is more business than tech related, but for some reason I am not able to post it to the business community, so I’m posting it here.

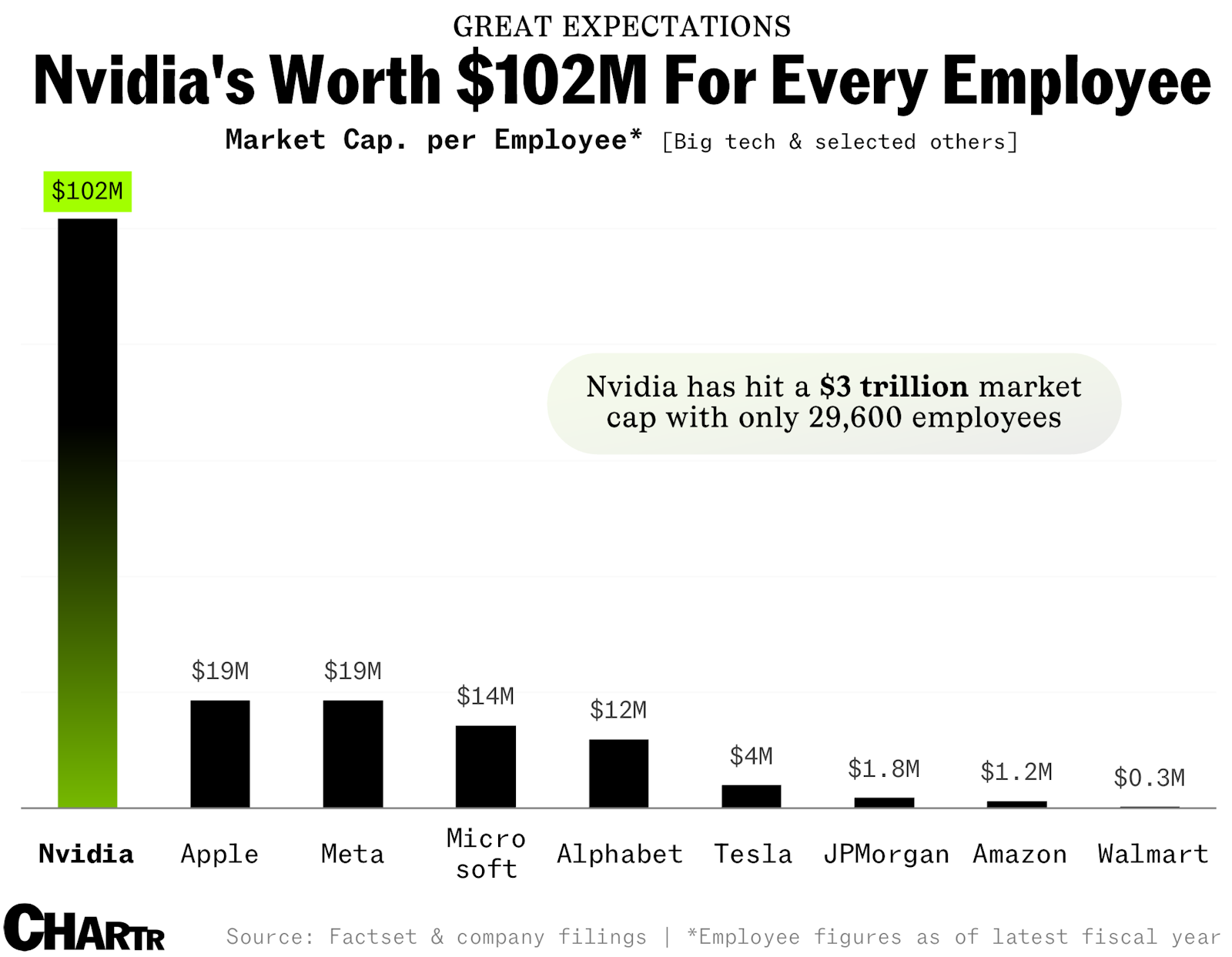

"…For Nvidia, after this latest run-up took it north of the $3T milestone, the company is being valued at more than $100M for each of its 29,600 employees (per its filing that counted up to the end of Jan 2024).

That’s more than 5x any of its big tech peers, and hundreds of times higher than more labor-intensive companies like Walmart and Amazon. It is worth noting that Nvidia has very likely done some hiring since the end of January — I think the company might be in growth mode — but even if the HR department has been working non-stop, Nvidia will still be a major outlier on this simple measure.

We are running out of ways to describe Nvidia’s recent run… but a nine-figure valuation per employee is a new one."

The AI bubble

Nvidia is in a great spot for the AI bubble.

It drives up prices now, but when the bubble eventually burst, data centers are still going to need accelerators for more viable compute tasks.

Absolutely the most robust business in the bubble.

And every employee will recieve the industry standard 3% raise based on performance at the end of year.

You guys get raises?

Yes and if your employer doesn’t give you one you should leave.

I’m like 90% sure Nvidia employees get stock options, but I’m not sure if that’d be the case for the newest batch of hires.

But yeah, this is a clear cut illustration of how salaries undervalue the actual labour provided, I don’t think any Nvidia employee’s getting 100M from their stocks + salary.

Ummm, nope. Some might, but not everyone by a longshot. Salaries aren’t great either.

RSUs are kinda shit too though. According to coworkers at my company that are actually valued enough to receive them, they’re pretty difficult to sell

RSUs cannot be sold, but they can be vested.

Very true. I personally know two people who were at Nvidia who have retired/are in the process of leaving now, and it hasn’t been a hassle for them personally. That obviously doesn’t speak for everyone ofc.

I also think Nvidia wants to buy back as many shares as possible from their employees like every other big public tech giant is doing right now.

From this, it describes someone losing half a billion dollars which would leave them with over 300 million. That doesn’t sound too bad and is unrelated to difficulty with RSUs.

Valuation per employee…doesn’t pay the employees their worth. Or anywhere near it.

I was excited that the employees were logged as primary shareholders. Like every employee in every company should be.

https://feddit.uk/post/12865710

[The execs and above are] Well compensated for pouring jet fuel on climate disaster.

Delete Nvidia

At least the article points out that this is a Wall Street valuation, meaning it’s meaningless in reality, the company doesn’t have that much money, nor is it actually worth that much. In reality, Nvidia’s tangible book value (plant, equipment, brands, logos, patents, etc.) is $37,436,000,000.

$37,436,000,000 / 29,600 employees = $1,264,729.73 per employee

Which isn’t bad considering the median salary at Nvidia is $266,939 (up 17% from last year).

Book value doesn’t take into account future value, wall street value does

Meaning speculation. Just because someone is willing to buy Nvidia stock at a $3 trillion valuation doesn’t mean it will someday achieve that kind of tangible value.

What’s the difference, really?

The market ultimately dictates value

Cool. I am glad to know I imagined the real estate crash of 2007.

The difference is that the stock market has a very distorted definition of value.

If you say that the value of something is what someone else is willing to pay for it, I could trade my house with a friend and say they paid a billion for it, except they paid me with their own billion-dollar house, and we would both become billionaires. Of course, that would be bullshit, but if my friend and I sat on the board of the FED, it would somehow become actually real.

I see how that works, but the question is, how far can that stretch? Wall Street already tells us there is stuff worth more than 40 years of the US GDP trading around in their pockets, so how much more can that get before they get called on their bullshit like me and my hypothetical friend?

It’s a ponzi scheme

I could trade my house with a friend and say they paid a billion for it, except they paid me with their own billion-dollar house, and we would both become

billionairestaxed into poverty.Except we would grab loans from our banker friends who are also in on the scheme, and use some of that money to pay taxes and buy some congresscritters to avoid further taxes. The banker guys would then grab some loans themselves, preferably also from each other, as they slowly repackage the whole thing and then sell it to retirement funds to make it everyone else’s problem. /s

At least the article points out that this is a Wall Street valuation

Market cap is not just a “Wall Street valuation” (whatever that means).

meaning it’s meaningless in reality

Tell that to the stockholders.

The stockholders don’t live in reality either

Personally I’m an AMD guy, I don’t like the proprietary approach Nvidia takes to everything.

But I have to admit, Nvidia has been on the ball for 30 years now, and it’s very impressive what they have achieved.

I think the rest of the industry needs to pool together around an open standard, if they want to have a chance to compete against the near monopoly Nvidia has because of CUDA.Is there anything fundamentally superior about Cuda over open CL?

Yes: market share. And Nvidia has the top performing cards on the market, so there’s no reason to go with a competitor.

And inertia. Same reason x86/64 is still the king. Nobody wants to update their software to a new architecture

Exactly. People will do it if there’s a big enough incentive, but that just doesn’t exist for openCL.